A huge challenge for childcare providers is trying to engage with parents who are always busy.

From regular updates to permission slips, parents want to hear from those looking after their children as much as possible.

Sending kids off to school tends to get easier with time, but for families of nursery age children, this process can be particularly hard.

Because of this, more and more childcare providers are using technology to their advantage to keep parents in the loop and engaged in their nursery child’s lives.

Letting parents feel involved – even when they’re not there

With everyone’s lives getting busier and busier, families often spend more time apart than ever before. In fact, many children with working parents spend more time with their childcare providers than they do with their parents in their own home.

Unfortunately, little ones can’t tell their parents all about their day, as much as their parents might want them to. So, it’s up to childcare providers to keep parents connected and invite families to get an insight into what their children are doing and learning.

Involving parents in their children’s education and care – even from afar – can really help parents feel connected to their children even if they can’t physically be there all the time.

An easy way to achieve this is to use mobile technology. Sending updates – whether that’s spontaneous pictures and videos, weekly newsletters, or monthly round-ups – to parents’ phones offers a convenient and quick way to build some interaction and connection.

Helping parents feel organised and informed

Mobile notifications

Aside from the sweet connection that a quick, mobile-based update can give to a parent, mobiles can be incredibly useful when childcare providers need access to fast and reliable information.

If staff need to communicate quickly and effectively with parents about important things like dietary requirements, allergies, or medication, it’s much better to do so over mobile.

The alternative is spending ages filling out and signing forms, or waiting until the parent picks the child up to raise the issue. Simply using a mobile saves you (and the parent!) time and stress when important information is needed.

Online enrolments and online payments

Parents are incredibly busy. From work to looking after children – and even just getting everyone out of the door on time – there’s not a lot of spare time to spare. Saving parents just a little time is so useful.

Most parents don’t have the time or the energy to check their child’s enrolment status or make a long-winded payment.

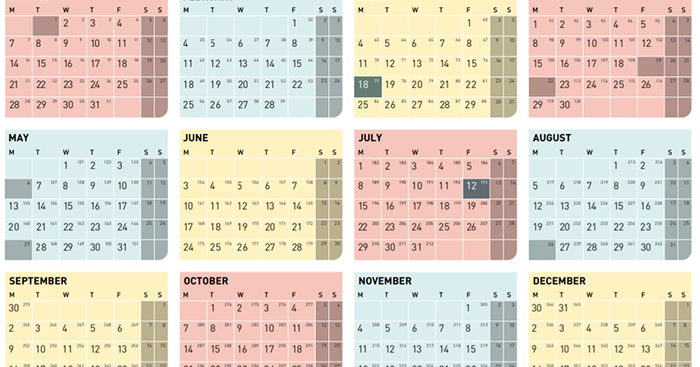

Moving childcare admin to an (often mobile) online portal that parents can access is an excellent way to make sure parents are always up to date with basic information like enrolment times, field trips and activities, facility closures, and even important changes to policies.

Online portals can also allow busy parents to pay for their childcare on the spot, instead of having to set aside time to go through a long payment process. In fact, many childcare providers are cutting this step out altogether, and are using Direct Debit to collect regular fixed payments from parents without even having to worry about it.

Parents can still check all information online, but it allows parents and childcare providers alike to take some of the stress and effort of keeping on top of payments and use it to improve a child’s care. This convenience increases the chances of more parents paying on time, and that can take a lot of pressure off your business – and busy parents.

Keeping parents at the forefront of all communications will build a stronger relationship between your business and your clients. Allowing them to feel connected to their little ones and to easily communicate with you using easy, mobile-based systems will often make pretty much every aspect of your childcare business run just that little bit more smoothly.

Now, send that photo of the macaroni masterpiece over to that child’s parents!